Immigrants entering the United States should know about the tests and taxation laws.

There are 21 flash cards in this set (6 pages to print.)

To use:

1. Print out the cards.

2. Cut along the dashed lines.

3. Fold along the solid lines.

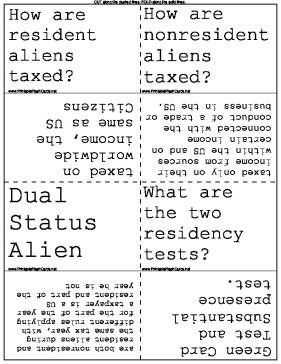

Sample flash cards in this set:

| Questions | Answers |

|---|---|

| How are resident aliens taxed? | taxed on worldwide income, the same as US Citizens |

| How are nonresident aliens taxed? | taxed only on their income from sources within the US and on certain income connected with the conduct of a trade or business in the US. |

| Dual Status Alien | are both nonresident and resident aliens during the same tax year, with different rules applying for the part of the year a taxpayer is a US resident and part of the year he is not |

| What are the two residency tests? | Green Card Test and Substantial presence test. |

| Green Card Test | a taxpayer is a lawful permanent resident of the US any time during the tax year. They may choose to be treated as a resident alien for an entire calendar year. |

| Substantial Presence Test | Without a green card a taxpayer must be physically present in the US for at least: 1. 31 days during the current year AND 2. 183 days during the 3 year period that includes the current year and the 2 years immediately preceding the current year |

| For the purpose of the 183 day requirement, all the days present in the current year are counted along with: | 1. 1/3 of the days present in the 1st year before the current year AND 2. 1/6 of the days present in the 2nd year before the current year |

| Can you pass the substantial presence test and still be an undocumented immigrant? | YES |

| Days in the US are not counted if the alien taxpayer: | 1. regularly commutes to work from Canada or Mexico 2. in the US as a crew member of a foreign vessel 3. is unable to leave due to a medical condition that arose in the US 4. is a professional athlete in the US to compete in a charitable sports event 5. is an exempt individual |

| What days do professional athletes count for the substantial presence test? | athletes exclude only the days in which they actually competed in the sports event, but do not exclude days used for practice, travel or promotional events. |

| Exempt individuals for the substantial presence test include: | 1. foreign government related individuals in the US temporarily, such as diplomats 2. teachers on temporary visas. scholars are exempt for 2 years 3. students on temporary visas who do not intent to reside permanently in the US. they are exempt for 5 years |

| When is a taxpayer considered a nonresident alien for tax purposes? | if the taxpayer does not meet the green card test or substantial presence test. |

| What portion of income is taxable for nonresident aliens? | taxed only on their US source income. |

| When may a nonresident alien who does not meet the substantial presence test or green card test still elect to be treated as a resident for tax purposes? | if he is married to a US citizen or resident. |

| An election to be treated as a resident for tax purposes only may be elected if: | 1. at the end of the year, 1 spouse is a nonresident alien and the other is a citizen or resident, AND 2. both spouses agree to file a joint return and to treat the nonresident alien as resident alien for the entire tax year. |

| What is classified as an international student? | anyone who is temporarily in the US on a F, J, M or Q visa. |

| What status do most international students and scholars fall under? | nonresident aliens |

| Who is also considered students for tax purposes? | Immediate family members of a student, including spouses and unmarried children under age 21 who reside with the student |

| When is a taxpayer considered a duel status alien? | when he has been a resident alien and a nonresident alien in the same tax year. |

| What determines a taxpayer status? | a taxpayers status on the last day of the year will determine if he is a resident alien or nonresident alien |

| What part of income is taxed for a nonresident alien? | taxed only on his US source income. |